As a leader in digital marketing for your financial services company, such as a bank, credit union, or fintech, you already know the mandate. Your board of directors is not interested in impressions or social media vanity metrics. They want to see net new money through loan and deposit growth, and they want to see it now.

The reality is that traditional tactics are not enough anymore. Newspaper ads, in-branch signage, and even broadcast campaigns may build awareness, but they struggle to translate into measurable growth on their own. Customers start their financial journeys online, usually on their cellphones, and often with a single question: “Where should I open an account?” or “How do I start saving for the future?”

Smart website design for financial institutions like banks and credit unions matters more than ever before, as you create a full-service digital branch that will meet your customers’ needs.

Table of Contents

A review of Inbound and Loop Marketing

That’s where two marketing frameworks become key to success.

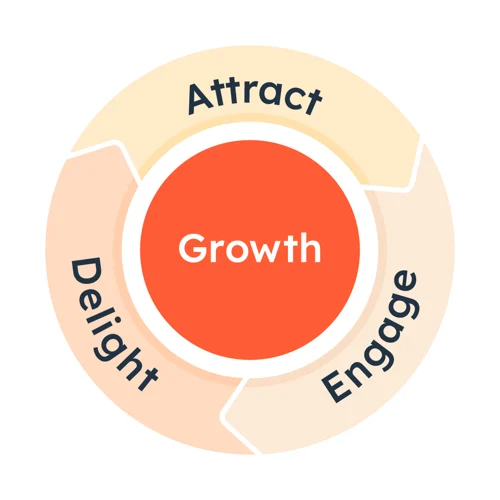

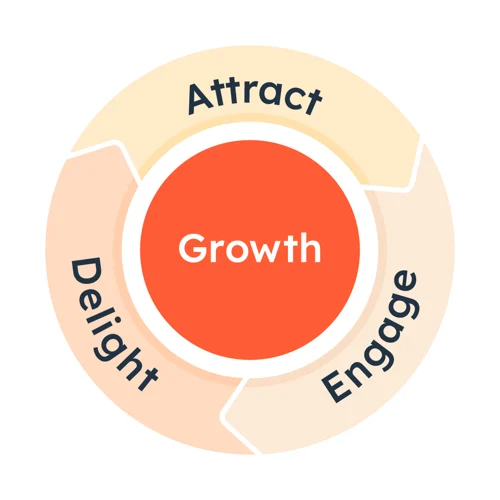

The first framework is inbound marketing. The inbound methodology focuses on three sections of a flywheel:

- Attracting visitors with useful answers.

- Engaging prospects through seamless digital experiences.

- Delighting customers with ongoing support that turns first-time depositors into lifelong promoters of your brand.

Once the inbound flywheel is in motion and compounding, the next step is measurement. This ongoing stage ties marketing reporting directly to the outcomes your board actually cares about, the new accounts opened and deposits gained through your efforts.

As the marketing landscape shifts and your institution’s AI maturity grows, the inbound flywheel evolves alongside a more intelligent loop. As effective inbound marketers, you will face new challenges and opportunities.

Awareness that was once centralized is now dispersed across fragmented channels.

Once abundant website traffic is beginning to shrink.

Conversions that once were slow and manual are now fast and assisted by these AI tools.

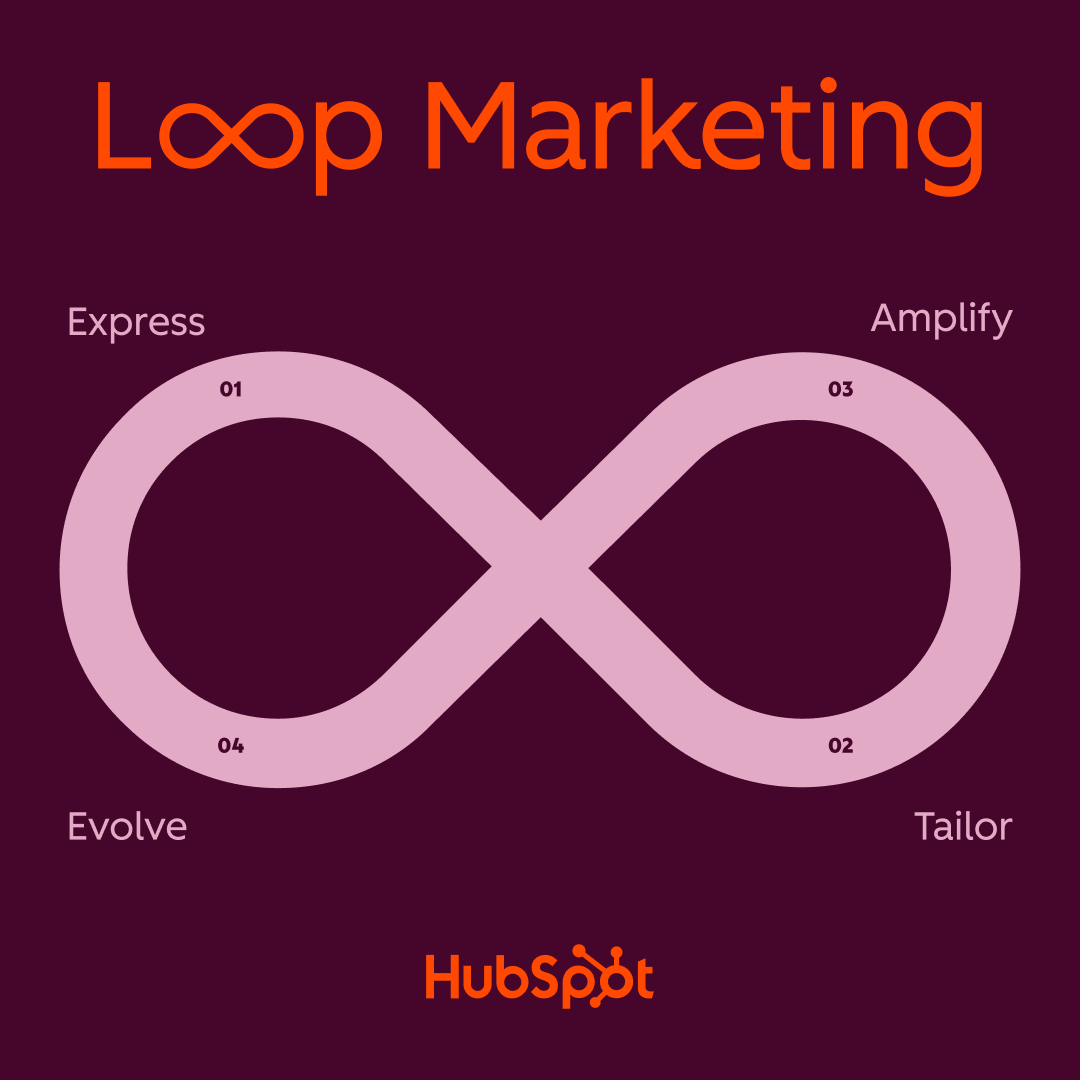

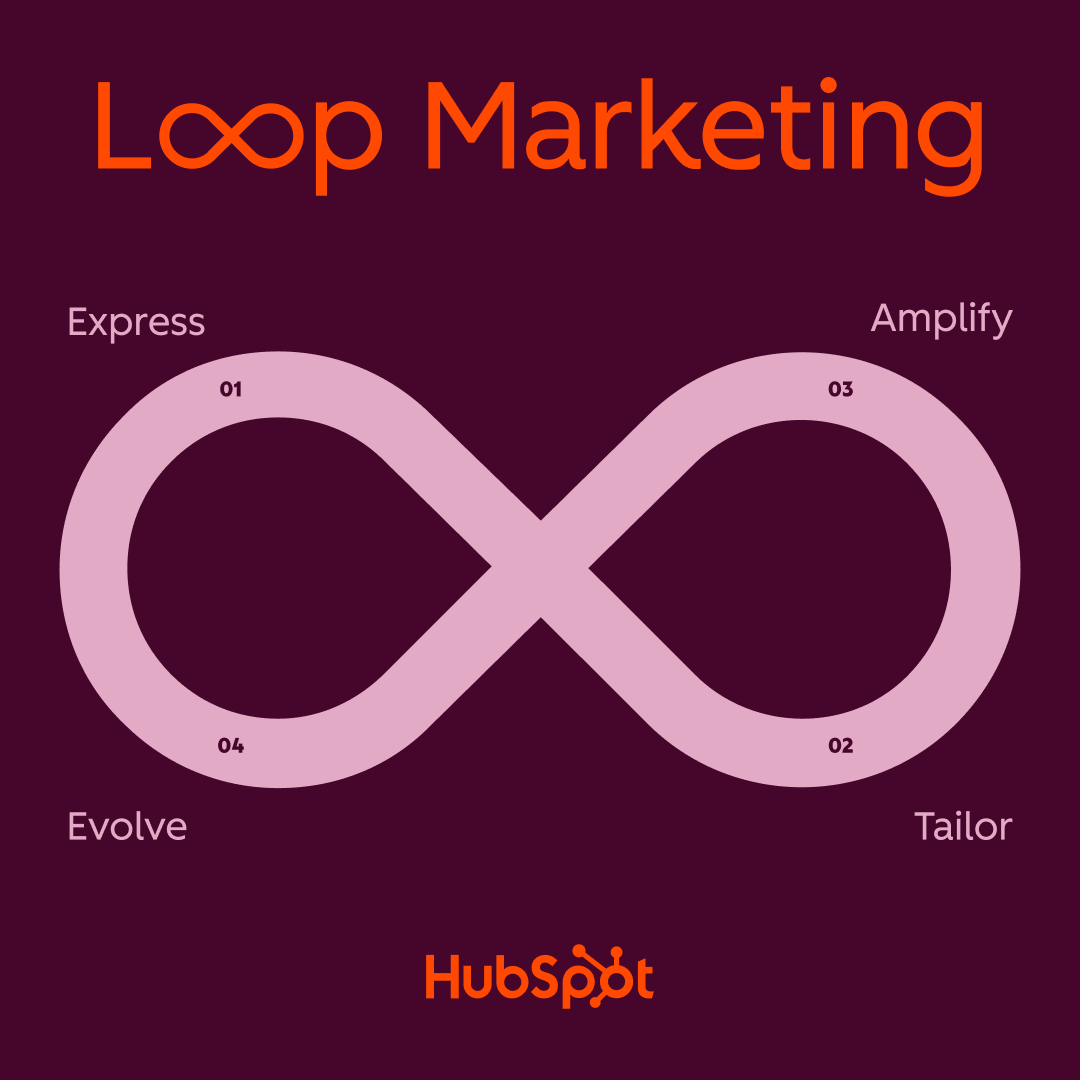

The second framework is HubSpot’s new Loop Marketing playbook. Building on efficiencies between what AI does best and your unique brand voice, Loop Marketing is a campaign-centric feedback engine layered on top of the inbound flywheel. The four stages of this Loop Marketing Playbook are:

- Express who you are by defining your brand voice using your ideal customer personas.

- Tailor your approach, using AI tools, toward prospects and customers with highly contextual personalization.

- Amplify your reach across the diverse range of channels that now exist, from new social media sites to AI query results.

- Evolve in real-time through iterative, automated, and agile experimentation.

Each Loop cycle (Express → Tailor → Amplify → Evolve) is a micro-iteration that drives momentum in the flywheel stages (Attract / Engage / Delight). The better your loops, the more force you apply to the flywheel, and the less friction you carry forward.

Each new campaign that incorporates the Loop framework into your larger inbound flywheel becomes both a generator of deposits and fresh insight to power the next loop.

For financial institutions, mastering the attract–engage–delight cycle, as well as growing more comfortable with thinking in terms of a Loop methodology, transforms a website from an online brochure into a true digital branch, and is the most powerful driver of growth.

Attracting customers through digital discovery

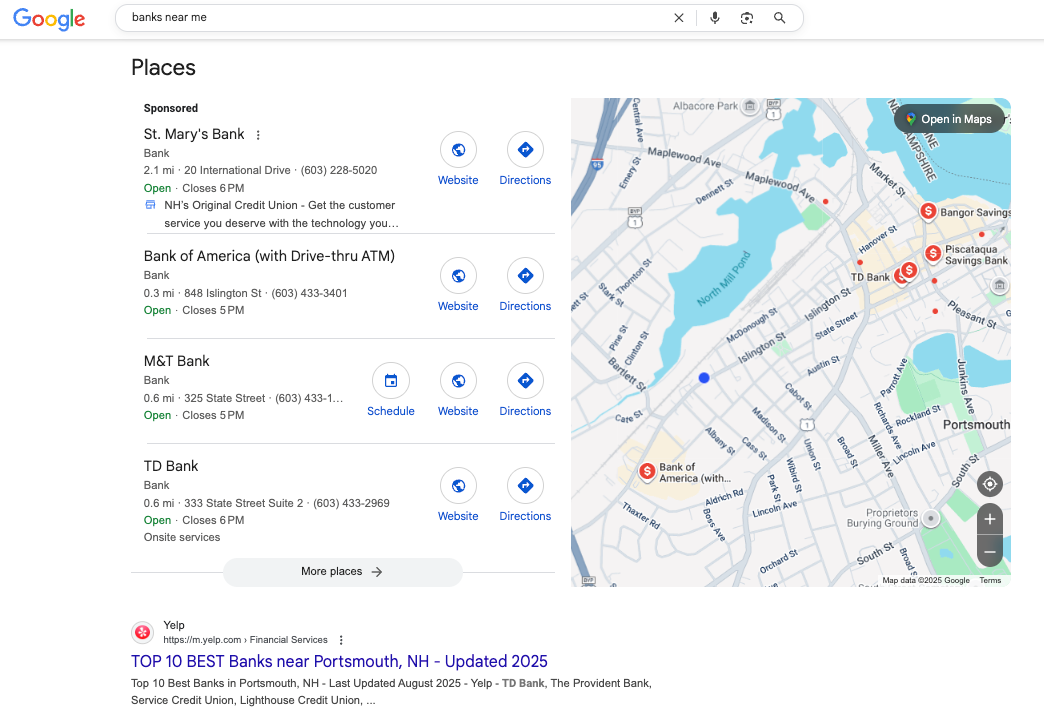

Inbound marketing starts with discoverability. Customers cannot choose your institution if they cannot find you. That means financial services marketers must optimize for both traditional search engines and emerging answer engines powered by AI.

In Loop Marketing, Express is your starting point, clarifying your brand’s identity, voice, and positioning so that every piece of content and AI-driven message feels unmistakably yours. That clarity is critical when optimizing for local SEO and amplifying conversational discovery across AI tools.

How local SEO fuels deposit growth in financial services marketing

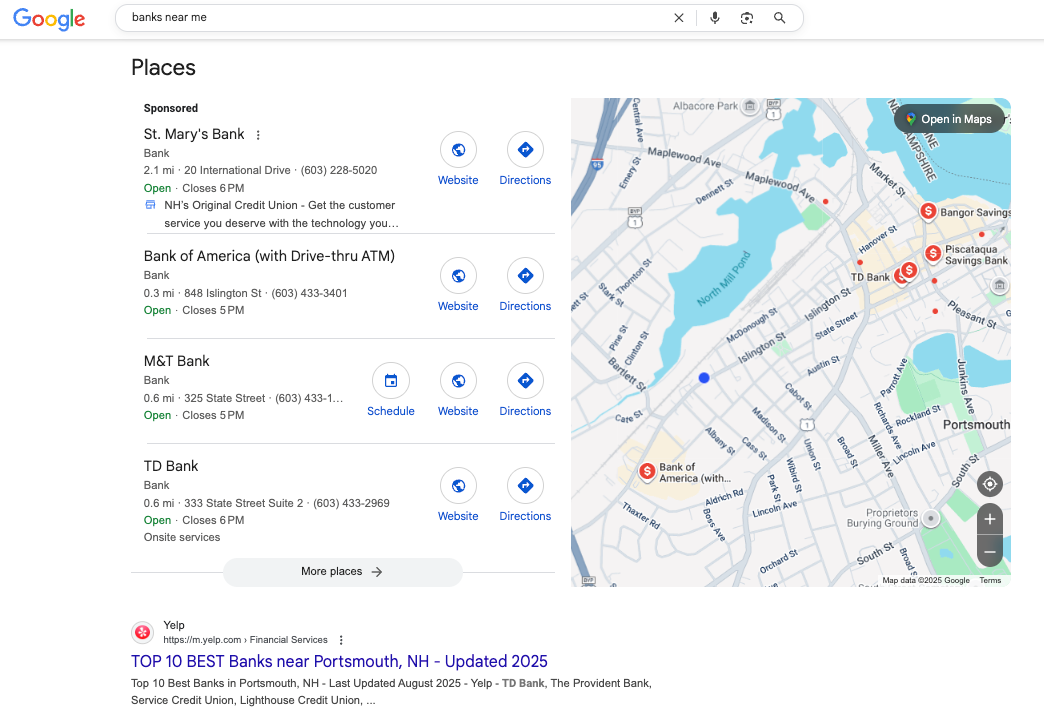

For many institutions, the growth path begins locally. When someone searches for “best checking account near me” or “credit union savings rates [city],” they are not idly browsing. They are signaling intent to act, and if your institution doesn’t appear in those results, a competitor will.

Local Search Engine Optimization is about consistently showing up in high-intent moments. Here are a few techniques to get you started:

- Get Google under control. Claim and optimize Google Business Profiles for every branch, ensuring details like hours, services, and photos are complete and accurate.

- Highlight local stories. Create location-specific landing pages on your site that speak directly to customers in that market, highlighting local staff. Promote regionally relevant offers and speak to your local community impact initiatives.

- Personalize with localization in mind. Personalized local content should also lean local, with blog posts about saving for college in a university town or retirement planning in a community with a large senior population.

- Ask for reviews. Improve your presence on Google Reviews and sites like Yelp to gain trust and authority in search results. Ask for reviews from customers after major positive life events, such as the closing of a mortgage or financing of a first car. Follow up on negative reviews with prompt sincerity; this shows how your team acts on the negative feedback your institution receives.

By aligning your digital presence with local intent, you ensure your brand is discoverable exactly when it matters most. Each appearance in a “near me” search is another opportunity to convert local demand into deposits.

Why answer engine optimization (AEO) matters to your financial institution

Tools like ChatGPT or Perplexity are increasingly shaping consumer behavior, answering questions that do not need to drive site traffic. Structuring content for Answer Engine Optimization (AEO), sometimes called Generative Engine Optimization (GEO), is no longer optional.

These answer engines, powered by AI, map relationships between concepts, not just individual terms. That’s why the goal isn’t ranking for a single keyword, but creating a web of related content that signals your expertise across the entire category you want to lead.

A key content strategy in AEO and GEO is the creation of pillar pages that serve as the base for different “topic clusters" of related, useful content. A pillar page, as defined by HubSpot, is a comprehensive single page, longer than a typical blog post, that broadly covers a topic in its entirety, with hyperlinked detailed blog posts leading back to this pillar page. These centralized pillar pages and clusters of related, useful content ensure that web crawlers find the right information served up in the answer to a query.

Technical SEO is another key consideration in AEO and GEO, such as using schema markups to structure your content. Schema markups are a key back-end tool that structures the data on your website into a variety of types, allowing both traditional search and AI engines to more easily crawl your website. We’ve laid out what’s changing and what you can do to stay ahead of this curve with a data-driven SEO strategy.

Your website as a digital branch: Designing for Jobs to Be Done (JTBD)

Think of your website as your busiest branch, only it has no street address, no teller line, and no closing hours. For many customers, your website will be their very first impression of your institution. The difference is that this branch doesn’t have tellers or lobby signage to guide people where they need to go. The navigation, the content, and the user experience have to play that role.

Too many financial institutions design websites around their internal structure, Retail Banking, Commercial Banking, and Wealth Management. But that is not how your customers think. They do not show up saying, “I need a product from Retail.” They show up thinking, “I need to get my paycheck deposited faster,” or “I need a way to save for college.”

Reframing your navigation and content around your customer’s Jobs To Be Done makes a difference. JTBD reminds us that your customers are "hiring" your institution’s products or services to achieve a specific goal or make progress in a particular situation. This means that what matters most to your customers is completing whatever job they are hiring your products to do.

JTDB theory explains why categories like Everyday Banking, Business Growth, or Planning for the Future resonate far more than internal labels. Content that speaks to real problems, like major life changes and events, deep emotional needs, or achieving goals and dreams, will connect faster and remain in your customer’s memory longer than product features or interest rates alone.

A good digital branch feels less like a filing cabinet of services and more like a branch manager asking, “What brought you in today?”

Personalization as a driver of engagement

Discovery is only the beginning. Once a visitor lands on your site, engagement depends on how well you can meet their needs. A single generic homepage experience is like a teller handing every branch visitor the same pamphlet, no matter their needs. Cookie-cutter content doesn’t build confidence, and it doesn’t move people to act.

The Loop’s Tailor stage upgrades personalization from “nice-to-have” to foundational, thanks to the new tools at our fingertips. By combining CRM, intent data, and behavioral signals, you can craft hyper-contextual experiences at scale, not just surface-level personalization. Over time, each personalization becomes a learning point in the loop, refining future engagement.

Starting small: Building personalized journeys for high-value segments

Personalization allows your website to behave more like a conversation. A visitor exploring mortgage resources should see “Start Your Application” instead of “Learn More.” A student logging in from a university town should encounter messaging and offers for student checking. These tailored experiences don’t just feel nicer; they directly improve conversion rates by making every visitor feel understood.

Personalization is not about overcomplicating things with dozens of journeys at once. Start with one high-value segment, like first-time homebuyers or students, and build a personalized path for them. Then expand to other audiences. Each step moves your website closer to functioning like the branch manager who already knows why you walked in.

Using HubSpot for smarter financial services marketing personalization

If you use HubSpot, you already have powerful personalization tools at your fingertips. Smart Content and Smart CTAs, an often-overlooked feature, let you tailor the messaging of CTAs, website copy, landing pages, and emails to the exact needs of each segment you’ve set up.

The result? Every visitor sees messaging that feels relevant to them, not a one-size-fits-all experience.

Delighting customers to build long-term value

Growth doesn’t stop at acquisition. Inbound marketing is built on the idea that the delight stage fuels momentum, and in financial services, that is where the real compounding happens.

A customer who feels supported is far more likely to add balances, open secondary accounts, and become a long-term advocate. These customers may eventually come to see you as their primary financial institution, the gold standard for customer engagement.

Here are a few key considerations for how you can best delight your new customers:

- Streamline your onboarding process. Attracting visitors and earning clicks means nothing if customers drop out halfway through an application. Treat onboarding as a conversion journey, focusing on the user experience (UX) at every step of the process. Shorter forms, staged data collection, and mobile-first design reduce the drop-off. Progress indicators reassure customers they’re moving forward. Save-and-return functionality respects the reality that people may need to pause and come back later. Automated reminders can bring them back to finish what they started.

- Personalize your onboarding communications. Bringing personalization back into your content strategy, guide new customers through high-value tasks like activating cards, enrolling in mobile banking, or setting up direct deposit. Target your customers with products, services, and knowledge that meet their needs and align with their segment.

- Retarget like a retailer. Abandonment during digital onboarding is one of the most common and most costly killers of deposit or loan growth. Think like Amazon and retarget to ensure that your customers do not slip through the cracks. Reminding someone of an application they started last week can bring them back at the right moment.

- Compliance doesn’t have to mean complexity. Building in streamlined disclosures, easy-to-read terms, and secure document upload tools reassures customers that their information is protected while keeping the process moving. When fraud prevention and regulatory requirements are handled elegantly in the flow, they don’t feel like roadblocks; they feel like part of a trustworthy experience.

Delight is not only your retention anchor. In Loop Marketing, it also feeds the Evolve stage. Every satisfied or unsatisfied interaction yields signals you can use to iterate your next attract or engage cycle. Support tickets, feedback surveys, mobile usage, churn signals, they all become ingredients in your evolving loop.

Relevant, timely cross-sell offers that respond to customer behavior help to deepen the relationship. A checking account customer who sets up direct deposit may be ready for a savings plan. A small business owner with a loan may need treasury services. Every positive digital interaction builds trust. Over time, that trust translates into deeper relationships, bigger balances, and stronger customer lifetime value.

Measuring ROI in financial services marketing

No matter how compelling your strategy, it won’t resonate in the boardroom if you can’t prove the impact. Many financial services marketing teams fall short here. Reporting stops at clicks and impressions when shareholders and board members really want to see new deposits and loans, or higher non-interest income.

Closed-loop reporting solves that gap. Your reporting should feel cohesive and connected. Marketing reporting ties in with data living in your CRM, origination systems, the core, card servicers, and digital banking platforms.

The reporting stage makes the Loop operational. The Evolve stage lives in your analytics. As campaigns run, AI and data help you discover which messages, channels, or segments succeed, and immediately feed that learning back into your Express, Tailor, or Amplify stages. The cycle, from measurement to insight and then action, is how your system self-improves.

A centralized data warehouse and reporting tool, like HubSpot’s new Data Hub, ensures you have a single source of truth to work from when reporting on the effectiveness and performance of your marketing activities. With the right tools, you can show the entire buyer journey, from campaign engagement to application start, and from funded account to long-term customer activity.

That level of visibility transforms conversations with leadership. Instead of saying, “This campaign drove 2,000 visits,” you can say, “This campaign generated 300 new accounts and $5M in deposits.” That’s the kind of proof that secures resources, builds trust, and elevates marketing from a cost center to a growth driver.

Why digital marketing works for financial services

Financial services marketing has changed. Marketing results do not just come from expensive billboards or newspaper ads. Sustainable deposit growth now requires meeting customers online, anticipating their needs, making it easy to act, and nurturing lasting relationships.

Inbound marketing aligns naturally with how your customers make financial decisions. You are not just forcing them down a funnel. Instead, you build momentum with a flywheel that attracts with valuable content, engages through seamless experiences, and delights with ongoing support, leading to deeper relationships.

Inbound’s attract–engage–delight philosophy still underpins smart financial marketing, but Loop Marketing adds the next layer of faster iteration, cross-channel agility, and perpetual learning. When your digital branch embraces Express, Tailor, Amplify, and Evolve in harmony with inbound, your deposit growth engine becomes self-enhancing, not static.

Your website is not just another channel. It is your most important branch. And with the right digital strategy, it can be your most profitable one.

Ready to make your website your financial institution’s inbound growth engine?

Raka partners with banks, credit unions, and fintechs as your financial services digital marketing agency to design inbound strategies and provide the creative and technical expertise to bring that strategy to life.

Let’s talk about how we can build your digital branch together.